Hello City Council:

I’ve reviewed the staff report and draft RFP for the Moraga Canyon Specific Plan (MCSP) and submit the following comments and questions. Hopefully you can delve into them.

The MCSP is good planning, but clearly the RFP is being developed to expedite a City application for Measure A funds by 2024. Perhaps for that reason, the RFP is short on explaining how the plan addresses important city policies. Table 2 list these policies but the RFP states that these policies “may” be considered and only stipulates that the consultant team will demonstrate “professional experience and knowledge of the personnel general principles and background law applicable to specific plans, land development and affordable housing development requirements”. There are important sustainability policies outlined in the General Plan and Climate Action Plan and the City should stipulate this a credential it seeks on the consultant team. Does the team have a sustainability expert like our City does? Traffic safety is another core credential that should be requested.

The staff report and RFP suggests that additional environmental review beyond the programmatic EIR will be conducted based on the impacts of the specific projects in the MCSP. That makes sense but is predicated on a robust programmatic EIR which has yet to be released. Without the programmatic EIR being public at this time, the generalities of that assessment may be used to gloss over specific impacts of the projects at a later date. One way to alleviate this concern is to assure that the programmatic EIR will have a response to comments process as a project specific EIR does. Staff should confirm this publicly. Subsection m. in scope of services should clarify this point as well.

One important EIR consideration is whether an assessment of GHG emissions will be undertaken in the MCSP. This assessment may occur in the “built out” programmatic EIR so this may not be a factor but without that document, who can say? To resolve this question, staff should clarify whether these GHG emission calculations are being conducted as a part of the programmatic EIR. According to state guidance, GHG emissions are to be part of a CEQA analysis: CEQA GHG. However, based on certain criteria, affordable housing projects under 100 units are exempt from CEQA and staff should clarify this as well CEQA Housing. Indeed, staff should clarify whether CEQA is applicable to all the projects being considered in the MCSP, particularly the low-income housing projects.

The staff report and RFP do not clarify whether the relocation of the Corporation Yard will be studied as part of the MCSP. The only possible reference to this is that “replacement” of the Corporation Yard be considered. The City should clarify this in the RFP so as to provide consultants the widest latitude to develop creative proposals for the canyon. Indeed, this latitude may provide for the subdivisions of parcels and development standards that are attractive to builders of housing at all income levels. As staff envisioned with civic center sites, the City could leverage better housing for the project if the Corporation Yard is moved to less desirable building site in the canyon.

Following are more specific comments/questions to the RFP:

The project timeline on page 5 of the staff report is particularly short on detail. The City seems not to have identified the type of public process it intend to conduct.

Under “Specific Plan for Success” there is no mention of field lighting as part of the recreational facilities to be developed. Is it the intent of the City and this Council not to proceed with the installation of lights at Coaches Field? There is some precedent for this.

The landscape plan makes no mention that it is to comply with the City’s municipal Bay Friendly Landscape Ordinance which has specific criteria for vegetation and water use.

Garrett Keating, Former Piedmont City Council Member

Another Consultant is proposed to be hired at an unspecified cost to produce a Moraga Canyon specific plan.

“The RFP does not set a price, but … [in 2019] … the preparation of a specific plan cost an average of $544,237.” according to ABAG.

On the Council Agenda, Tuesday, January 17, 2023 the City of Piedmont returns to the previously unexamined, controversial legal opinion of the Piedmont City Charter when the City Attorney dismissed the specific language within the Piedmont City Charter of requiring voter approval of proposed zoning changes. Agenda > >council-agenda 1.17.23

This program requires an amendment to the City’s General Plan and the preparation of a specific plan to accommodate the density and create development standards for the unique site conditions. The required amendments would be reviewed by the City Attorney for conformance with the City Charter and other legal requirements. If it is determined that it is infeasible to develop this site during the planning process, the City will consider utilizing other City-owned properties as alternative sites (see Appendix B).

Funds generated by General Plan Maintenance fee instituted by the City on July 1, 2019 will provide significant funds for General Plan costs – plans and zoning changes.

Currently, the fee is $0.013 x the construction cost valuation on building permits. The fee generated $427,000 in FY 21-22 and the City expects a similar amount this fiscal year. The funds must be spent on updates and amendments to the General Plan and other auxiliary documents (e.g., Climate Action Plan, Zoning Ordinance, Hazard Mitigation Plan, and a specific plan). The City Council might consider increasing this fee to help cover the rising costs of land use planning.

READ the full staff report in the link below:

Moraga Canyon Plan Consultant 1.17.23

Stay Informed about the Moraga Canyon Specific Plan

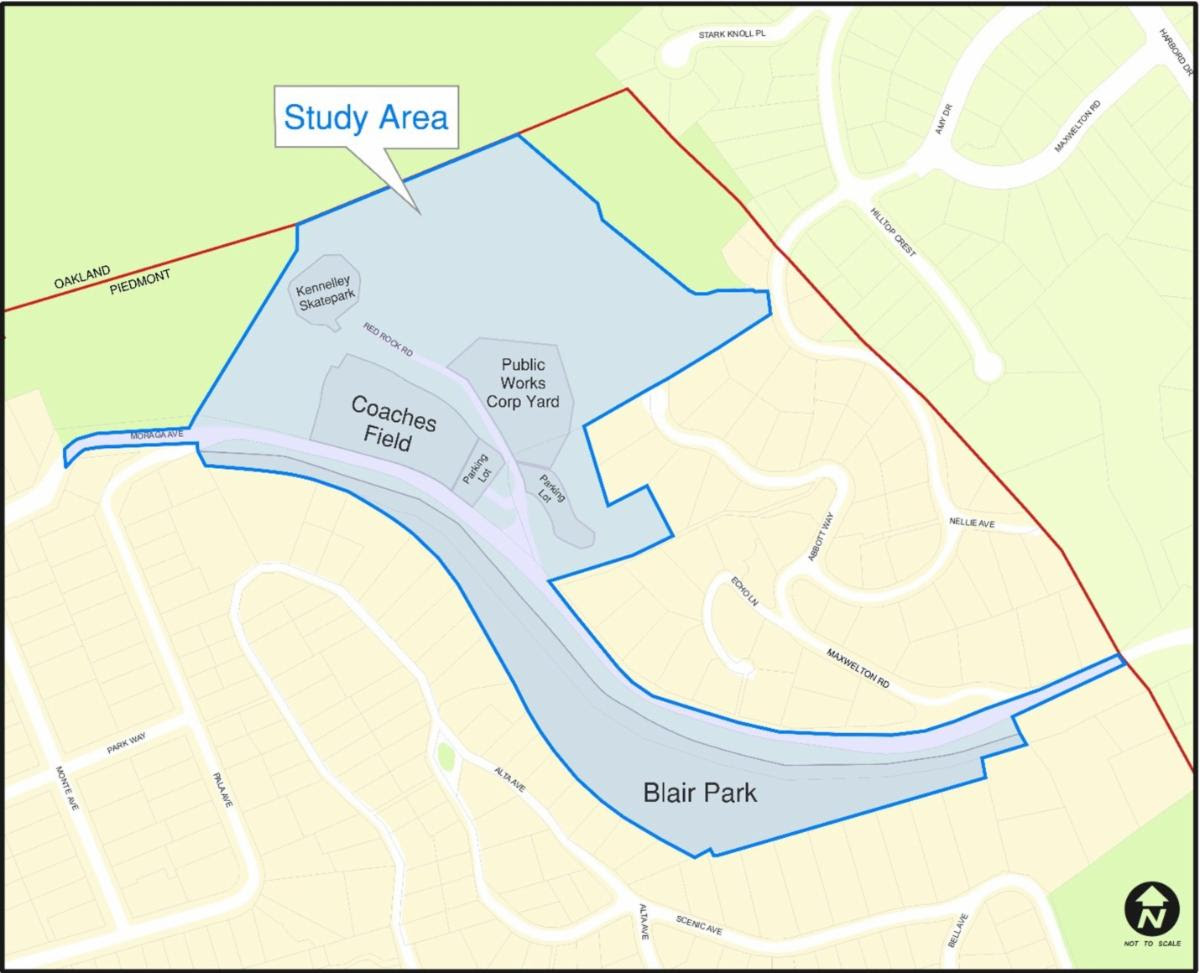

After the City adopts a 6th Cycle Housing Element, a key piece of the implementation process will be the creation of a Moraga Canyon Specific Plan. This initiative will study all City-owned land in Moraga Canyon with the goal of creating a detailed plan for how to maintain and improve existing amenities while also incorporating new housing in the area.

The City expects to issue an RFP in late January seeking professional services to lead this process. Stay informed by subscribing to our Moraga Canyon Specific Plan email list.

Piedmont Pool Complex Costs Continue to Rise Beyond the Bond Package Fund Approved by Voters –

The Piedmont Recreational Facilities Organization (PRFO) is seeking $2.1 million additional funds for the project. The City Council will receive an update on the fundraising campaign and authorize staff to develop naming agreements for contributions of $250,000 or greater to the project. Consideration will be at the Tuesday, January 17, 2023 Council meeting. council-agenda 1.17.23

Staff report linked below:

Will the Council revert back to not recording, broadcasting, or archiving video recordings of certain public meetings? The cost of transparency via video broadcasts has proven to be minimal given the City budget. On the council-agenda 1.17.23

The California Brown Act has been amended and provisions changed.

NEW REQUIREMENTS:

If members participate remotely using the just cause or emergency provisions, the following additional rules apply:

• The legislative body must provide a way for the public to remotely participate in the meeting and must provide notice of how to access the meeting and offer comments

• The public must also be permitted to attend the meeting in person

• The body cannot require public comments to be submitted before the meeting but rather must be allowed in real time.

• Remote members must participate through both visual and audio (i.e. cameras and microphones on)

• Before any action is taken, remote members must disclose whether any other people over 18 years old are present in the room at the remote location and the general nature of the member’s relationship with the individual

Editors’ Note: The Piedmont Civic Association has long advocated maximum adherence to Brown Act applicable public meetings such as commissions, committees, and City Council. The Piedmont City Charter prescribes these meetings are to keep minutes, which has not been adhered to for even critically important Council appointed committees such as the Budget Advisory and Financial Planning Committee.

The Public Safety Committee during the COVID protocols was newly recorded and live streamed. Some meetings, the Annual City Budget Workshop and the interviewing of candidates for City Council, commission and committee appointments have historically not been recorded, broadcast, or archived leaving access to only those present at the meeting.

Transparency and accountability are important to the public and should be maximized by the City Council by improving the archiving of recordings, providing minutes, and live streaming of public meetings.

READ the staff report linked below:

Changes to Brown Act and Next Steps 1.17.23

League of California Cities – report > https://www.calcities.org/news/post/2022/12/15/brown-act-changes-are-coming-to-cities-in-2023.-here-is-what-to-expect

Attached is a press release providing anticipated key dates for the City’s Housing Element update in January. Staff expect to bring Piedmont’s 6th Cycle Housing Element to the Planning Commission for review on January 12, 2023 and to the City Council for adoption on January 30, 2023.

Additionally, staff intend to issue an RFP in late January seeking professional services to lead the preparation of a Moraga Canyon Specific Plan. Once a consultant has been selected, the Specific Plan process is expected to take 18-24 months to complete. The City has created an email list community members can subscribe to for updates about the Specific Plan. Also attached is an informational poster about the Moraga Canyon Specific Plan that we shared with community members at the Housing Element Open House in November.

12.22 Poster+3+Moraga+Canyon+Specific+Plan+Study Map

Morga 2022-12-20 Housing Element Update Key Dates in January Press Release

|

|

|

|

|

|

|

|

|

|

Adding 587 new housing units –

COMMENT PERIOD IS NOW OPEN UNTIL JANUARY 8, 2023 –

Piedmont officials in the notice below provide no mention of the City Charter requirement for voters to approve zoning changes permitting many of the 587 new housing units necessary for an updated Piedmont General Plan. Zoning code changes are required to incorporate the pending Housing Element into the General Plan. The City notes the necessity of “changes to the land use categories” without mentioning the City Charter requirements.

Since the Housing Element was first considered and subsequently approved by the City Council for state consideration, residents have mentioned numerous concerns regarding the addition of the 587 new housing units. NOW, until January 8, 2023 is the time to inform the City of Piedmont of any environmental or other concerns you may have. See below for contact address. If you want your concern or interest to be part of the permanent record, note it in your communication and ask that a copy be sent to the Piedmont City Council.

kjackson@piedmont.ca.gov is noted as the primary contact.

|

|

|

|

Groundbreaking Ceremony for New Community Pool Saturday, December 17th, 11 a.m.

Construction is expected to begin in early 2023, and the new pool could open as soon as summer 2024.

The City of Piedmont invites community members to a groundbreaking ceremony for the new Piedmont Community Pool on Saturday, December 17th at 11am. The ceremony will be held on the grounds of the pool site at 777 Magnolia Avenue.

…………………

The Piedmont City Council voted unanimously to award a contract for construction of the new pool to Wickman Development & Construction at their December 5th, 2022 meeting.

Construction is expected to begin in early 2023, and the new pool could open as soon as summer 2024.

“It took the collective effort of hundreds to reach this point, including current and former Councilmembers, City staff, Commission and Committee volunteers, consultants, and most important – the community advocates who have tirelessly pursued the vision for an aquatics facility that truly meets Piedmont’s needs, some of whom have been working towards this goal for over two decades” said City Administrator Sara Lillevand. “I hope many community members will join us on December 17th to celebrate this monumental milestone.”

Originally opened in 1964, Piedmont’s now-shuttered pool had exceeded its useful lifespan and had long lacked adequate space to meet the community’s diverse aquatic athletic and recreational needs. Although there have been several efforts to explore feasibility of a new facility over the years, work on the pool replacement project began in earnest in 2015, with the development of the Aquatics Center Conceptual Master Plan.

This vision drew closer to reality in November 2020 with the passage of Measure UU, which authorized the sale of $19.5 million in general obligation bonds to fund the new facility. A sharp rise in construction costs beginning in 2020 further threatened the project’s feasibility, leaving a gap of more than $2 million between project cost estimates and available funds even after the City Council scaled back the original design to include only essential components.

To close the gap, the City has partnered with the Piedmont Recreational Facilities Organization (PRFO) to raise $2.1 million for the completion of the new community pool as designed. This capital campaign, which began in August 2022, looks to build on the success of previous PRFO fundraising in support of Hampton Park and the Corey Reich Tennis Center.

As of December 5th, 2022, PRFO is nearly halfway to the fundraising goal of $2.1 million. The City of Piedmont and the Piedmont City Council remain grateful to the community for their ongoing support for the new community pool project.

For more information on the project, visit piedmont.ca.gov/newpool.

For information on the PRFO capital campaign, visit prfo.org/piedmont-community-pool.

Does this mean the draft Piedmont Housing Element is in a 30-day comment period which commenced November 17?

From the California Housing and Community Development (HCD) website:“Housing Element Submittal Requirements:”.“For first draft submittals: With the first draft submittal, please include in the cover letter how the local government complies with new public participation requirements pursuant to AB 215 (Chapter 342, Statutes of 2021). AB 215 requires that prior to submittal of the first draft to HCD, the local government must make the draft available for public comment for 30 days and if any comments were received, take at least 10 business days to consider and incorporate public comments. Please note, HCD cannot review any first draft submittals that have not demonstrated completion with this requirement. The housing element will be considered submitted to HCD on the date that documentation has been received verifying compliance with AB 215 public participation requirements.”..Garrett Keating, Former Member of the Piedmont City Council