Piedmont Pensions: 44 Percent and Rising

Past Council and Voter Decisions Create an Unpleasant Surprise. How did it happen? – –

The City has maintained an independent Police and Fire Department since 1907. Initially Piedmont maintained its own retirement fund for police and fire personnel. Contribution levels and investments were the responsibility of trustees consisting of Piedmont citizen and staff (including at various times the Mayor, Vice Mayor, and representatives from the departments). Eventually Piedmont switched to CalPERS pensions. For many years, the City’s safety personnel were covered under the CalPERS retirement plan of 2%-at-50.

(The annual retiree benefit is derived by calculating 2% of the highest compensation year, then multiplying by the number of years worked. Example: Highest year salary of $132,000 x 2% x 32 years of employment.)

Changes in the fire and police retirement plan were added to the City Charter as of 1979:

“The pension system for members of the police and fire departments as set forth in Section 47 of the Charter in effect on January 1, 1979, shall be incorporated in the City Code, and any amendment thereto shall not be effective unless approved by a majority of the voters voting thereon at a general or special election.”

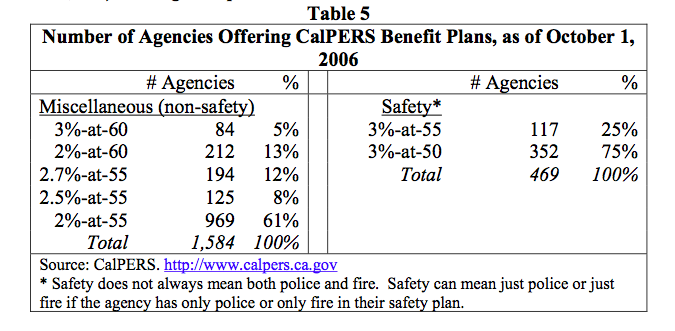

At 2%-at-50, the fire and police pension plans were more generous than miscellaneous employees plans: they permitted safety employees to retire at age 50 rather than 60. The 2%-at-50 pension plan was the standard for public safety members throughout California until 2000, when legislation was passed authorizing CalPERS to offer 3%-at-50 and 3%-at-55 plans for public safety members. At the same time, CalPERS added new plans for miscellaneous employees: 2% at 55 to 3% at 60, with fractional increments within that range.

A seemingly small change – from 2% to 3% – in the new plans represented a substantial pension increase: 50% greater pension benefits for the rest of the employee’s life. To illustrate, at retirement with a salary of $132,000 after 30 years of employment:

- A 2% plan = > $132,000 x 30 year x 2% => 60% pension of highest year of compensation would result in an annual $80,000 pension for lifetime

- A 3% plan = > $132,000 x 30 years x 3% => 90% pension of highest year of compensation would result in an annual $120,000 pension for lifetime

CalPERS predicts little or no cost to Piedmont for increasing pensions by 50%

CalPERS advised cities and other employers that the large increase in retirement pensions should cost the employer little – or even nothing – anticipating its investment earnings would cover all or most of the cost. After the 3%-at-50 plan became standard for the State of California employees, fire and police employees for Contra Costa and Alameda counties were offered the 3%-at-50 plan and the plan spread among California cities. According to Piedmont staff, the City began having trouble retaining its paramedic/firefighters. Turnover costs were high: Piedmont is required to pay full salary during the lengthy Academy Training period for every new hire. (Hiring and turnover within the Piedmont Police Department appears not to have been a significant issue.)

Partially in response to labor market conditions, and with assurances from CalPERS and staff of limited cost impact, Piedmont followed suit and approved increases for police and fire pensions.

Police and fire pensions were increased from 2%-at-50 to 3%-at-55 plan as of January 1, 2004. The change included police as well as fire, despite a lack of reported turnover or hiring issues within the Police Department. This change represented a 50% increase in pension pay each year after retirement. The increased pay continues until death of the retiree and his spouse.

(The change was negotiated as part of employee contracts approved by the Council. It was subsequently affirmed by a city-wide vote, as required by the 1979 City Charter requirement.)

On January 1, 2004, pension plans for Miscellaneous employees also jumped from 2%-at-60 to 3%-at-60, a 50% increase in pension pay for life, though no hiring problems were publicly noticed.

On January 1, 2008, police and fire were enhanced again, going to a 3%-at-50 plan which reduced the age of retirement from 55 to 50.

A Hidden Cost Increase: Retroactive Pension Upgrade

Each time the pensions were increased, Piedmont increased the pensions retroactively for current employees. As a result, instead of increasing pensions from (for example) 60% to 70%, pensions jumped from 60% to 90%. The impact of a retroactive versus a non-retroactive pension increase is shown below, using the example of a 2% pension changing to 3% after 20 years of service, and retirement occurring after 30 years:

initial 2% pension = 60% pension

(past 20 years x 2% + future 10 years x 2% = 60%)

non-retroactive increase to 3% = 70% pension

(past 20 years x 2% + future 10 years x 3% = 70%)

retroactive increase to 3% = 90% pension

(past 20 years x 3% and future 10 years x 3% = 90%)

The decision to increase pension benefits retroactively has resulted in an extra $8 million liability to the City of Piedmont to CalPERS, known as the “Side Fund”. This liability is currently being paid off at an imputed interest rate of 7.75% (a rate mandated by CalPERS). Annual payments to retire the side fund will end in approximately 10 years. This Side Fund contributes to the City’s high pension costs.

44% pension costs an unpleasant surprise

CalPERS’s “no cost” promise was based on rosy investment earning projections which failed to materialize.* Rather than being “no cost”, past decisions to increase pensions have resulted in large increases in Piedmont’s pension costs.

These increases, imposed by CalPERS and not controllable by the City, have come as an unpleasant surprise. The cost of increasing pensions and the cost of retro-activity were not anticipated at the time these past decisions were made. While the City anticipated an increase in police and fire pensions to 33% of salary, it never anticipated rates would rise to the current level of 44% of salary, according to staff responses to inquiries at a BAFPC meeting. This difference represents an unanticipated 33% jump in Piedmont pension costs. For example, using the $132,000 salary that a firefighter might receive:

33% annual pension cost => $43,560 per year anticipated

44% annual pension cost => $58,000 per year incurred

Difference: the pension cost is 33% more than anticipated

Piedmont’s contribution costs for police and fire pensions are projected to continue rising beyond 44% in the next 5 years. And even with these escalating contributions, the CalPERS pension pools in which Piedmont’s employees participate will be left underfunded by CalPERS.

The Budget Advisory and Financial Planning Committee (BAFPC) has determined that Piedmont’s current pension plans are unsustainable. (See BAFPC report.) It calculated that CalPERS pensions are underfunded by roughly 80% as to active employees. The BAFPC also calculated that Piedmont faces $40 million in total unfunded pension and medical benefit liabilities as of 2012 – and an ever-increasing unfunded liability in the future – without substantial changes to its current pensions and benefit structure. Recent changes in employee contracts have not addressed the ever-increasing unfunded liability which Piedmont faces. Piedmont revenues are increasingly being diverted to pay a high cost for retiree benefit contributions – yet failing to fully fund pensions for employees who will be retiring in the future.

Piedmont faces ever increasing unfunded liabilities

A City consultant has estimated the City’s future CalPERS contribution cost increases using “high-middle-low” range projections. The low and medium ranges were close in cost, predicting about a 2% rise per year in the next few years. The “high” range suggests an alarming possibility: pension contributions as high as 75% of salary within 5 years.

It should be noted that an annual CalPERS pension increase of “2%” is pegged to base salary, rather than current pension cost. As a result, an innocuous “2%” increase in the CalPERS contribution rate actually represents a hefty 5% increase in benefit costs.

44% pension cost on $132,000 salary: $58,000 cost

2% CalPERS cost increase calculated on full salary: $2,640

$2,640 represents a 4.55% (not 2%) annual increase in pension costs of $58,000

In the same way, Piedmont’s CalPERS costs may be described as having “increased 15%” over the last 5 years. Yet this CALPERS accounting terminology, which refers to 15% of salary, disguises an actual cost increase of almost 50% compared to the historical pension costs. This is a second instance where traditional CalPERS terminology tends to obscure the actual increase in pension costs.

Traditional municipal accounting formats also tend to hide rising pension costs. First, ongoing increases in pensions totaling 50% in 5 years are not reflected by a year-over-year budget. Second, 5-year budget histories, often part of a yearly budget, are brief summaries which leave pension and benefit increases buried within other figures. Third, the very helpful initial 5-year budget projections completed as part of the 2012 BAFPC efforts did not highlight or unmask pension cost increases. (Pension costs were first detailed only as a percent of salary, and then converted directly into percent of total compensation figures in combination with other benefits. The increase in pension costs as a percent of past pension costs was not calculated, nor highlighted via separate sidebar figures.)

Standard accounting formats thwart the easy tracking of a rise in benefit costs, making it difficult for lay persons tasked with monitoring these and other City benefit costs to do so. The Finance Director, Mark Bischel, has plans for new and improved BAFPC budget information next year which will be more “granular”. This is intended to allow more key budget costs to be identified, highlighted, and tracked through the budget process. New spreadsheets will also allow revenue and expense variables to be “played with” to assess their cost impact and model the future effects of various options.

Doing the Math: Calculating Actual Pension Cost

Pensions are affected by a number of factors: age of retirement (50 vs 55 vs 60), using the highest 3 years vs 1 year of salary, vesting rate (2% vs 3% per year of employment) and assumed earnings rate on the pension fund. Analysis by the Budget Advisory and Financial Planning Committee indicates the vesting rate (2% or 3%) and earnings rate have the greatest impact on the contribution cost of pensions.

Piedmont calculates “salary” for public safety employees using the highest year of salary, rather than an average of the 3 highest years of salary. Either option is available under CalPERS. A member of the BAFPC pointed out that this practice can lead to “gaming” and may be encouraging turnover in the Police Department: two past Piedmont Police Chiefs chose to retire little more than a year after being promoted to Police Chief, with the increased retiree benefit that went with it after 1 year.

Pension and other retirement benefits for Piedmont employees have been projected to increase over the next 5 years as follows:

- Pensions: 5% per year

- Medical: 7% per year

- Dental: 5% per year

- Vision: 3% per year

In absolute dollars, pension contributions (up to 44% of salary) represent a much larger cost than the other benefits.

Returning to lower 2% pension plans for new hires, a provision negotiated in recent employee contracts, will reduce future overall pension contribution costs at some distance point in the future, but has little or no immediate effect on current budgets.

Restoring the “average of the 3 highest years of employment” to calculate pension benefits for new hires will help prevent aberrant pensions and rapid turnover, but has little immediate effect on Piedmont costs.

Initiating $100 per month employee contributions for the medical retiree trust fund cannot halt the ever-escalating unfunded liability the City faces in this benefit. Maximum potential employee contributions would amount to less than $120,000 per year, while annual contributions of $1.6 million per year are required to halt the escalation of this unfunded liability. Some cities have moved to eliminate the medical benefits. The Piedmont Unified School District limited medical for retirees to age 65 approximately 2 decades ago.

The BAFPC describes the current pension and benefit structure as unsustainable. To ensure future employee pensions are funded and halt escalating unfunded liabilities, transitioning to defined contributions plans is recommended.

*Many are familiar with the recent losses by CalPERS during the 2008/09 financial crisis, but CalPERS losses have not been limited to the recent financial crisis. In late 2003, the Piedmont City Council adopted/approved a ballot argument and rebuttal in support of Measure S (for the 2004 ballot) which stated, “More than half of Piedmont’s increased pension costs are caused by past investment losses by the State pension fund. Piedmont’s annual pension contribution will increase by $600,000 even without any pension plan changes.”

Where was the oversight? Where was transparency? And now they want to close KCOM for LESS transparency.

Several cities have a Public Safety Chief, combined Fire and Police Chief. But Piedmont insists on 2 w/ all the benefits for a low number of homes which equal a low number of crime/fires. Do the math.

Seriously, these departments couldn’t be run by one person? Really!

Were members of City management who would be beneficiaries of the decision to increase pension benefits for Miscellaneous employees part of the decision process? How involved were any members of the City Council? Where was the oversight that might have questioned this 50% in pension increase in 2004 as well as the retroactive pension upgrade?

Maybe much of this increased cost, if it had not been incurred, would negate any need for ongoing parcel tax increases.

Much of this does NOT pass the “smell test” that normally happens in private industry.

As a last minute strategy to appear to meet some of the Municiple Tax Review Committee minority report expectations, the City has finally looked at using an outside consultant on the pension costs. In a related matter, the City negotiator for the contracts to date has been City Administrator Grote. I do not believe he can objectively negotiate on behalf of taxpayers contracts with people he works with on a daily basis.

The dramatic pension increases in 2004 were sold to public as necessary to keep the quality team of City staff intact.

My gratitude to the person or persons who did the hard work to put this analysis together.